Introduce

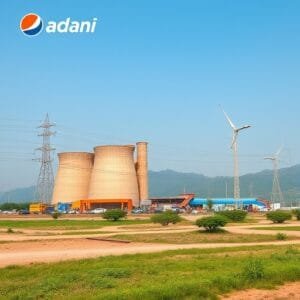

The energy story between Adani Power and Bangladesh has changed dramatically in recent times, with Adani Power cutting off much of its power supply to Bangladesh. The development has raised questions, speculations and analysis as energy is crucial to sustaining the economies and industries of both countries. To comprehend the underlying factors and the broader implications, let us delve into the intricate reasons behind this reduction in energy export and what it means for Bangladesh’s power landscape.

Understanding Adani Power’s Supply Reduction: Key Reasons and Dynamics

Economic Viability and Contractual Challenges

At the crux of the issue lies the delicate balance of financial viability. Adani Power, like any large company, operates within financial parameters that dictate its operations. Rising raw material costs and volatile energy prices have put pressure on profit margins. In the case of Bangladesh, the contractual arrangement was developed based on specific economic assumptions which may not be economically feasible for Adani under the current circumstances. As a result, Adani Power found itself in a situation where it was necessary to reassess the relationship between cost recovery and delivery commitments. Global coal price growth and fluctuations

The ongoing rise in global coal prices is another major driver influencing Adani’s sourcing decision. Adani Power’s power generation is highly dependent on coal, which has experienced significant price volatility due to global disruptions in coal mining and export markets. Rising coal costs have a direct impact on generation costs, making it difficult for Adani to maintain its previously agreed electricity exports. The financial pressures from this resource-intensive dependence, combined with rising international demand for coal, have resonated, resulting in a temporary drop in supply. Supply chain vulnerabilities amid global chaos

In addition to coal prices, the logistics framework that supports electricity generation and distribution faces a number of disruptions. Global supply chain disruptions, ranging from shipping delays to resource scarcity, limit the seamless flow of materials and resources needed to generate electricity. Adani Power’s operations are not immune to these global challenges, and the resulting inefficiencies have become operational bottlenecks affecting the reliability of Bangladesh’s uninterrupted power supply.

Politics and environmental regulations as key factors

India and Bangladesh have made great strides in regulating energy practices for sustainability. In recent years, India’s environmental policy has introduced stricter measures regarding emissions and resource consumption, particularly targeting coal-fired power plants. As Adani seeks to comply with these regulations, the necessary adjustments and changes to meet these standards may result in temporary reductions in production capacity, affecting its international obligations. Implications for Bangladesh Power Sector

The reduction in Adani’s electricity supply has significant implications for Bangladesh’s energy infrastructure and economic ambitions. Insufficient electricity supply could hamper industrial productivity, affect GDP growth and put pressure on energy-dependent industries. In response, Bangladesh may explore alternative energy deals, possibly accelerating the transition to renewable energy to reduce dependence on coal imports.

conclusion

Adani Power’s reduction in power supply to Bangladesh is a multifaceted issue driven by economic, environmental and logistical considerations. As both countries continue to grapple with energy interdependence, both can benefit from closer cooperation, energy diversification and a flexible contracting system that can withstand fluctuations in the global energy landscape. This situation highlights the importance of a strong energy partnership that can adapt to changing dynamics and ensure sustainable growth and stability for both sides.