Introduction:

In the world of personal finance and investment, retirees and investors are constantly seeking effective strategies to manage their wealth and generate a steady income stream. One such powerful tool that has gained significant popularity in recent years is the Systematic Withdrawal Plan (SWP). This comprehensive guide will delve deep into the intricacies of SWP, exploring its benefits, mechanics, and how it compares to other investment strategies like Systematic Investment Plans (SIP). Whether you’re a retiree looking to optimize your retirement income or an investor aiming to understand different wealth management techniques, this article will provide valuable insights into the world of SWP.

Understanding Systematic Withdrawal Plans (SWP)

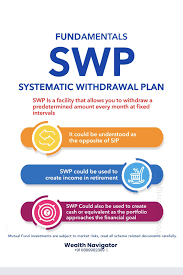

A Systematic Withdrawal Plan, commonly known as SWP, is a financial strategy that allows investors to withdraw a fixed amount of money from their mutual fund investments at regular intervals. This method provides a structured approach to liquidating investments, offering a steady income stream while keeping the remaining corpus invested for potential growth.

How does SWP work?

The mechanics of SWP are relatively straightforward:

- An investor chooses a mutual fund scheme and invests a lump sum amount.

- The investor then decides on a fixed amount they wish to withdraw periodically (monthly, quarterly, or annually).

- On the predetermined dates, the specified amount is automatically redeemed from the mutual fund and transferred to the investor’s bank account.

- The remaining investment continues to grow based on the fund’s performance.

Key features of SWP

Flexibility: Investors can choose the withdrawal amount and frequency.

Liquidity: Regular cash flow without the need to sell entire investments.

Potential for capital appreciation: The remaining corpus stays invested.

Tax efficiency: Withdrawals are treated as capital gains, which can be more tax-efficient than interest income.

Benefits of Systematic Withdrawal Plans

Regular income stream

One of the primary advantages of SWP is its ability to provide a consistent income stream. This is particularly beneficial for retirees who need a regular cash flow to meet their living expenses.

Capital preservation

Unlike selling off entire investments, SWP allows a portion of the corpus to remain invested. This approach can help preserve capital and potentially generate returns on the remaining investment.

Market timing neutralization

By withdrawing fixed amounts at regular intervals, SWP helps neutralize the impact of market timing. Investors don’t need to worry about selling their investments during market lows.

Customization

SWP offers a high degree of customization. Investors can adjust the withdrawal amount and frequency based on their changing needs and market conditions.

Tax efficiency

In many jurisdictions, withdrawals through SWP are treated as capital gains, which often have more favorable tax treatment compared to interest income.

SWP Strategies for Retirees

Assessing retirement needs

Before implementing an SWP, retirees should carefully assess their financial needs:

Estimate monthly expenses

Account for inflation

Consider healthcare costs

Plan for emergencies

Choosing the right mutual fund

Selecting an appropriate mutual fund is crucial for a successful SWP strategy:

Consider balanced or debt funds for stability

Evaluate the fund’s past performance

Look at expense ratios and exit loads

Assess the fund manager’s track record

Determining withdrawal rate

The withdrawal rate is a critical factor in ensuring the longevity of the investment:

The 4% rule: A common guideline suggests withdrawing 4% of the initial investment annually, adjusted for inflation.

Personalized approach: Consider individual factors like life expectancy, risk tolerance, and other income sources.

Periodic review and adjustment

Regular review of the SWP strategy is essential:

Monitor fund performance

Reassess withdrawal needs

Adjust for inflation

Rebalance the portfolio if necessary

SWP vs. SIP: Understanding the Differences

Basic concept

SWP (Systematic Withdrawal Plan): Regular withdrawals from an investment.

SIP (Systematic Investment Plan): Regular investments into a mutual fund.

Direction of cash flow

SWP: Money flows from the investment to the investor.

SIP: Money flows from the investor to the investment.

Purpose

SWP: Primarily used for generating regular income or liquidating investments.

SIP: Used for wealth accumulation and long-term investing.

Initial investment

SWP: Typically requires a substantial lump sum investment.

SIP: Can start with small, regular investments.

Market timing

SWP: Benefits from rupee cost averaging when selling units.

SIP: Benefits from rupee cost averaging when buying units.

Ideal for

SWP: Retirees, those needing regular income.

SIP: Young investors, those in the accumulation phase.

Implementing an Effective SWP Strategy

Assess your financial situation

Calculate your monthly expenses

Determine your risk tolerance

Evaluate your existing investments and income sources

Choose the right mutual fund

Research different fund options

Consider balanced or debt funds for stability

Evaluate past performance and fund manager expertise

Decide on withdrawal amount and frequency

Calculate how much you need regularly

Choose between monthly, quarterly, or annual withdrawals

Consider the 4% rule as a starting point

Set up the SWP

Contact your mutual fund company or financial advisor

Fill out the necessary forms

Provide bank account details for transfers

Monitor and adjust

Regularly review fund performance

Adjust withdrawal amounts if necessary

Rebalance your portfolio periodically

Potential Risks and Considerations

Market volatility

While SWP can help mitigate market timing risks, significant market downturns can still impact the investment corpus.

Inflation risk

If withdrawals are not adjusted for inflation, the purchasing power of the income may decrease over time.

Longevity risk

There’s a risk of outliving your savings if the withdrawal rate is too high or if market performance is poor.

Tax implications

While generally tax-efficient, it’s important to understand the tax treatment of SWP withdrawals in your jurisdiction.

Exit loads and fees

Some mutual funds may charge exit loads or fees for frequent redemptions, which can impact returns.

Case Studies: SWP in Action

Case Study 1: Retiree using SWP for regular income

Mr. Sharma, aged 65, retired with a corpus of ₹1 crore. He implemented an SWP strategy:

Invested in a balanced mutual fund

Set up monthly withdrawals of ₹33,333 (4% annually)

After 5 years, his corpus grew to ₹1.2 crores despite withdrawals, thanks to market performance

Case Study 2: Investor using SWP for child’s education

Mrs. Patel started an SWP when her child was 15, planning for college expenses:

Invested ₹20 lakhs in an equity mutual fund

Set up quarterly withdrawals of ₹1 lakh

By the time her child was 19, she had withdrawn ₹16 lakhs for education, while her remaining investment grew to ₹12 lakhs

Expert Opinions and Market Insights

Financial advisor perspectives

“SWP is an excellent tool for retirees to generate regular income while keeping their money invested. However, it’s crucial to choose the right fund and withdrawal rate.” – Rajesh Kumar, Certified Financial Planner

Market trends

Recent data shows an increasing trend of retirees opting for SWP over traditional fixed deposits, driven by potentially higher returns and tax efficiency.

Future outlook

With increasing life expectancy and changing retirement landscapes, experts predict SWP will play an even more significant role in retirement planning in the coming years.

Conclusion:

Systematic Withdrawal Plans (SWP) offer a powerful and flexible approach to managing investments and generating regular income, particularly for retirees. By providing a structured method of withdrawing funds while keeping the remaining corpus invested, SWP strikes a balance between income generation and potential capital appreciation.

While SWP shares some similarities with its counterpart, the Systematic Investment Plan (SIP), it serves a distinctly different purpose. Where SIP is geared towards wealth accumulation, SWP focuses on wealth distribution and income generation. This makes SWP an invaluable tool for those in the decumulation phase of their financial journey.

However, like any financial strategy, SWP is not without its risks and considerations. Market volatility, inflation, and the risk of outliving one’s savings are factors that need careful consideration. It’s crucial for investors to thoroughly assess their financial situation, choose appropriate funds, and regularly review and adjust their SWP strategy.

The case studies and expert opinions presented in this article highlight the real-world applications and benefits of SWP. They underscore the importance of personalized planning and the potential for SWP to meet diverse financial needs, from funding retirement to financing education.

As the financial landscape continues to evolve, SWP is likely to play an increasingly important role in retirement and investment planning. Its flexibility, potential for tax efficiency, and ability to provide regular income while keeping funds invested make it an attractive option for many investors.

In conclusion, whether you’re a retiree looking to optimize your retirement income or an investor seeking to understand different wealth management techniques, Systematic Withdrawal Plans offer a valuable strategy worth considering. As with any financial decision, it’s advisable to consult with a qualified financial advisor to determine if SWP aligns with your personal financial goals and circumstances. By mastering the intricacies of SWP, investors can take a significant step towards achieving their financial objectives and securing their financial future.