The AI Revolution in Personal Finance

Artificial Intelligence is no longer a futuristic concept—it’s reshaping how we manage money today. By 2025, 67% of Gen Z and 62% of Millennials already rely on AI tools for budgeting, investing, and debt management, driven by apps that offer hyper-personalized insights and automation14. The global AI-in-finance market, valued at 20.15billionin2022,isprojectedtosurgeto246 billion by 2031, reflecting a seismic shift in financial behavior11. This article explores how AI is transforming personal finance, from democratizing investment strategies to mitigating fraud, and examines the challenges of this tech-driven revolution.

1. Automated Budgeting & Expense Tracking: Precision Without Effort

AI-powered apps like Mint, Albert, and Wally have redefined budgeting by automating expense categorization and offering real-time spending alerts. These tools use machine learning to analyze transaction patterns, identify recurring subscriptions, and suggest areas to cut costs414. For example:

- Albert detects unused subscriptions and negotiates bills on your behalf, saving users an average of $300+ annually12.

- PocketGuard uses predictive analytics to forecast future expenses based on historical data, helping users avoid overspending14.

AI also simplifies financial goal-setting. Apps like YNAB (You Need a Budget) sync with bank accounts to allocate funds automatically toward goals like emergency savings or vacations, reducing the cognitive load of manual planning14.

2. AI-Driven Investment Management: Robo-Advisors & Beyond

Robo-advisors like Betterment and Wealthfront have democratized access to sophisticated investment strategies. These platforms use algorithms to build portfolios tailored to risk tolerance, time horizons, and financial goals, often at a fraction of the cost of human advisors14. In 2025, newer tools are pushing boundaries:

- Candlestick uses AI to analyze historical market data and generate weekly stock picks designed to outperform benchmarks12.

- Magnifi employs natural language processing (NLP) to let users ask questions like, “Which ESG funds have low fees?” and receive tailored recommendations12.

Generative AI is also transforming wealth management. Platforms like Origin combine tax planning, estate management, and investment advice into a single interface, offering holistic financial guidance previously reserved for high-net-worth individuals12.

3. Debt Management & Optimization: Smarter Repayment Strategies

AI is tackling one of finance’s most stressful challenges: debt. Apps like Trim and Tally analyze debt profiles (credit cards, student loans) to recommend optimal repayment strategies, such as the avalanche method (prioritizing high-interest debt) or snowball method (targeting smaller balances first)1011. Key innovations include:

- AI Negotiation: Trim’s algorithms negotiate lower interest rates or bills with providers, saving users up to 30% on recurring expenses12.

- Cash Flow Analysis: Tools like Rocket Money predict future income and expenses to suggest debt payments that won’t strain monthly budgets11.

4. Fraud Detection & Security: AI as Your Financial Guardian

Banks and fintech firms leverage AI to combat fraud in real time. Machine learning models monitor transaction patterns, flagging anomalies like sudden large withdrawals or purchases in unfamiliar locations614. For example:

- PayPal uses deep learning to analyze thousands of data points, reducing fraud rates to 0.32% (vs. the industry average of 1.32%)3.

- Biometric Authentication: AI-powered systems like Face ID and behavioral analysis (e.g., typing speed) add layers of security, minimizing identity theft risks10.

5. Personalized Financial Advice: Chatbots & Behavioral Insights

AI chatbots like Cleo and Erica (Bank of America) blend NLP and machine learning to offer conversational financial advice. Cleo’s humor-driven interface helps Gen Z users track spending, while Eno (Capital One) sends proactive alerts about suspicious charges1012. Advanced tools go further:

- Behavioral Finance: AI detects cognitive biases (e.g., impulsive spending) and suggests corrective actions, like automating savings to counteract emotional decisions11.

- Albert Genius: Combines AI with human experts to provide hybrid advice on debt consolidation or retirement planning12.

6. Credit Scoring & Loan Approvals: Fairer, Faster Decisions

Traditional credit scoring often excludes “thin-file” applicants with limited credit history. AI addresses this by analyzing alternative data:

- Utility Payments & Rent History: Apps like Experian Boost factor in timely bill payments to improve credit scores14.

- Social & Behavioral Data: Some lenders assess LinkedIn profiles or shopping habits to gauge reliability11.

AI also speeds up loan approvals. For instance, Upstart uses machine learning to evaluate 1,600+ data points, reducing default rates by 75% compared to traditional models11.

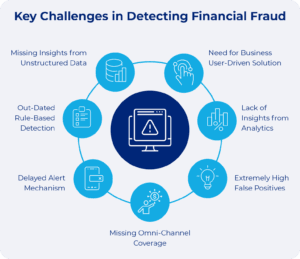

7. Challenges & Risks: Navigating the Dark Side of AI

While AI offers immense benefits, its adoption isn’t risk-free:

- Data Privacy Concerns: Breaches at AI platforms could expose sensitive financial data. Experts recommend using tools with AES-256 encryption and OAuth 2.0 protocols1014.

- Algorithmic Bias: Historical biases in training data may lead to unfair loan denials for marginalized groups. Regulatory frameworks like the EU’s AI Act aim to enforce transparency1114.

- Overreliance on Automation: AI tools can misinterpret data or offer flawed advice. For example, SEC warnings highlight cases where AI “hallucinated” investment strategies14.

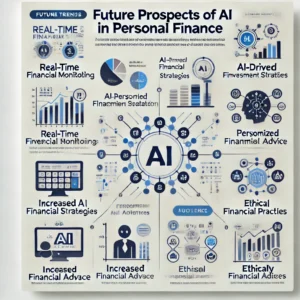

8. The Future of AI in Personal Finance: What’s Next?

By 2030, AI is expected to deliver even more groundbreaking features:

- Hyper-Personalization: Deep learning models like GPT-5 could analyze real-time spending triggers (e.g., location-based offers) to optimize savings10.

- AI-Powered Tax Optimization: Tools like TurboTax Live may automate deductible tracking and integrate with IRS APIs for seamless filing10.

- Emotional Intelligence: Future chatbots might detect stress in a user’s voice and adjust financial advice accordingly11.

Conclusion: Balancing Innovation with Caution

AI is undeniably transforming personal finance, offering tools that democratize access to wealth-building and reduce financial anxiety. However, users must balance automation with human oversight—consulting certified planners to validate AI recommendations and staying vigilant about data privacy. As the sector evolves, the fusion of AI’s efficiency with human intuition will define the next era of financial empowerment.