Introduction:

In the world of personal finance, Systematic Investment Plans (SIPs) in mutual funds have gained immense popularity among Indian investors. This investment strategy offers a disciplined approach to wealth creation, making it an attractive option for both novice and experienced investors. In this blog post, we’ll dive deep into the world of SIPs, exploring their benefits, drawbacks, and how they compare to traditional fixed deposits. We’ll also take a look at the historical performance of the Indian stock market to give you a better understanding of potential returns.

Systematic Investment Plans (SIPs)

What is a SIP? A Systematic Investment Plan (SIP) is an investment method that allows you to invest a fixed amount regularly (usually monthly) in mutual funds. Instead of investing a large sum at once, you invest smaller amounts over time, taking advantage of rupee cost averaging.

How does it work?

You choose a mutual fund scheme and decide on a fixed amount to invest regularly.

The amount is automatically deducted from your bank account on a predetermined date.

You receive fund units based on the current Net Asset Value (NAV) of the scheme.

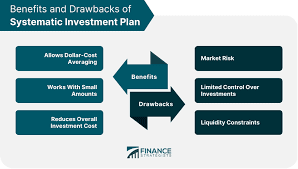

Pros of Investing in SIPs

a) Disciplined Investing: SIPs encourage regular, disciplined investing, helping you build a habit of saving and investing.

b) Rupee Cost Averaging: By investing a fixed amount regularly, you buy more units when prices are low and fewer when prices are high, potentially lowering your average cost per unit over time.

c) Power of Compounding: Regular investments over a long period can benefit from the power of compounding, potentially leading to significant wealth creation.

d) Flexibility: You can start with a small amount and increase it as your income grows. You can also pause or stop your SIP at any time.

e) Professional Management: Mutual funds are managed by experienced professionals who make investment decisions on your behalf.

Cons of Investing in SIPs

a) Market Risk: Like all market-linked investments, SIPs are subject to market volatility and there’s no guarantee of returns.

b) Requires Long-Term Commitment: To truly benefit from SIPs, you need to stay invested for the long term, which may not suit investors with short-term financial goals.

c) Fund Selection: Choosing the right mutual fund scheme is crucial and requires research and understanding of various factors.

d) Exit Load: Some mutual funds charge an exit load if you withdraw your investment before a specified period.

SIPs vs. Fixed Deposits

a) Returns:

- SIPs: Potential for higher returns, but with market risk.

- Fixed Deposits: Guaranteed returns, but generally lower than potential mutual fund returns over the long term.

b) Liquidity:

- SIPs: Generally more liquid, with the ability to withdraw (subject to exit loads in some cases).

- Fixed Deposits: Less liquid, with penalties for premature withdrawal.

c) Tax Implications:

SIPs: More tax-efficient, especially for equity mutual funds held long-term.

Fixed Deposits: Interest earned is fully taxable at your income tax slab rate.

d) Risk:

SIPs: Higher risk due to market exposure, but potential for higher returns.

Fixed Deposits: Lower risk with guaranteed returns.

Historical Returns in the Indian Stock Market

The Indian stock market has shown significant growth over the years, despite periods of volatility:

Sensex Performance:

The BSE Sensex, which started at 100 points in 1979, crossed 60,000 points in September 2021.

Over the past 20 years (2001-2021), the Sensex has delivered a CAGR of approximately 13-14%.

Nifty 50 Performance:

The Nifty 50 index has delivered a CAGR of around 12-13% over the past 20 years.

Mutual Fund Performance:

Many equity mutual funds have outperformed these indices over the long term, with some top-performing funds delivering 15-18% CAGR over 10-15 year periods.

It’s important to note that past performance doesn’t guarantee future returns, and individual fund performance can vary significantly.

Conclusion:

Systematic Investment Plans (SIPs) in mutual funds offer a disciplined and potentially rewarding approach to long-term wealth creation. While they come with market risks, their benefits of rupee cost averaging, professional management, and the power of compounding make them an attractive option for many investors. Compared to fixed deposits, SIPs offer the potential for higher returns and better tax efficiency, albeit with higher risk.

The historical performance of the Indian stock market demonstrates the potential for significant wealth creation over the long term. However, it’s crucial to remember that investing requires patience, discipline, and a clear understanding of your financial goals and risk tolerance.

Before starting a SIP, consider consulting with a financial advisor to determine if this investment strategy aligns with your personal financial objectives and risk profile. With the right approach and a long-term perspective, SIPs can be a powerful tool in your journey towards financial success.